trust capital gains tax rate 2020

Capital gains and qualified dividends. Capital gains taxes on assets held for a.

Tax Advantages For Donor Advised Funds Nptrust

The tax-free allowance for trusts is.

. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Events that trigger a disposal include a sale donation. Capital gains and qualified dividends.

Capital gains and qualified dividends. The maximum tax rate for long-term capital gains and qualified dividends is 20. Capital Gains Tax Rate.

The highest trust and estate tax rate is 37. 18 and 28 tax rates for individuals the tax rate you use. Add this to your taxable.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. For tax year 2022. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

The trustee of an irrevocable trust has. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. Capital gains is a tax paid on the profits made from the sale of an asset usually a property business stock or bond.

The remaining amount is taxed at the current rate of capital gains tax for trustees in the 2020 to 2021 tax year. 2019 to 2020 2018 to 2019 2017 to 2018. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Individuals 18 2021 2020 Companies 224 2021 2020 Trusts 36 2021 2020 Capital Gains Tax. 2022 Long-Term Capital Gains Trust Tax Rates.

Capital gains and qualified dividends. First deduct the Capital Gains tax-free allowance from your taxable gain. For tax year 2022.

What is the capital gains tax rate for trusts in 2020. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a. The maximum tax rate for long-term capital gains and qualified dividends is 20.

They would apply to the tax return filed in. An individual would have to make over 518500 in taxable income to be taxed at 37. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The maximum tax rate for long-term capital gains and qualified dividends is 20. What is the capital gains tax rate for trusts in 2022. For example if you were to start a company from scratch.

Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual. The following Capital Gains Tax rates apply. Which rate your capital gains will be taxed depends.

2023 capital gains tax rates. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. The following are some of the specific exclusions.

2022 capital gains tax calculator. For tax year 2020 the 20 rate applies to amounts above 13150. Irrevocable trusts are very different from revocable trusts in the way they are taxed.

What is the capital gains tax rate for trusts in 2022. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The maximum tax rate for long-term capital gains and qualified dividends is.

A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Find out more about Capital Gains Tax and trusts.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

How Are Capital Gains Taxed In An Irrevocable Trust

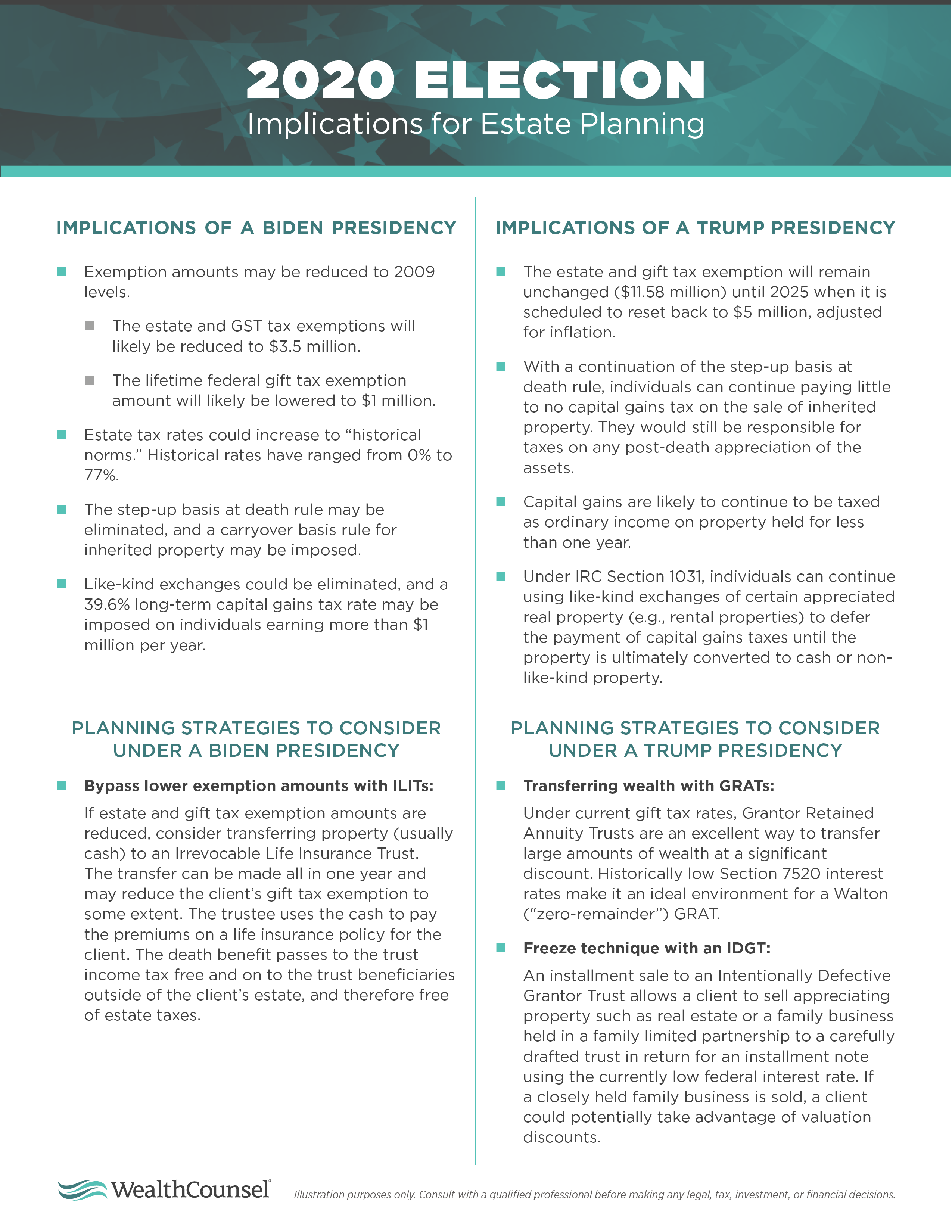

4 Election Year Tax Strategies You And Your Clients Need To Consider

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Review Your Financial Planning Opportunities For Any Presidential Election Outcome Commerce Trust Company

Question Help Pc 14 32 Similar To A Simple Trust As Chegg Com

What Is A Step Up In Basis Cost Basis Of Inherited Assets

2022 Capital Gains Tax Rates Federal And State The Motley Fool

2020 Year End Tax Planning For Trusts Can Yield Major Savings Accounting Today

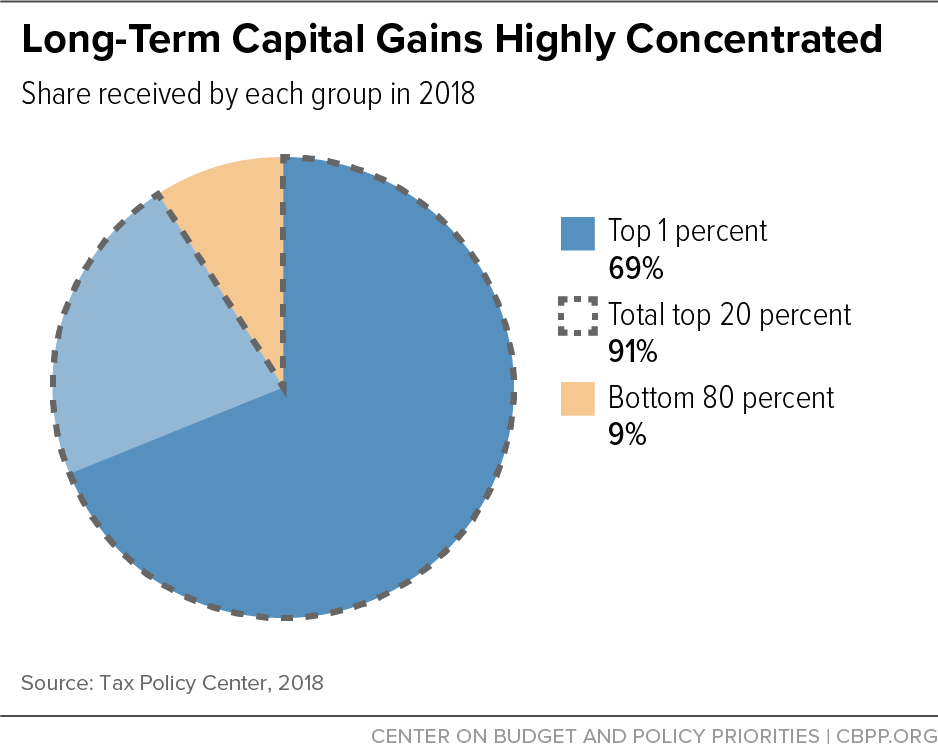

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

What You Need To Know About Capital Gains Tax

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Question Help Pc 14 32 Similar To A Simple Trust As Chegg Com