capital gains tax changes 2021

As a business seller if you are in. Long-term gains still get taxed at rates of 0 15 or 20.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Investors Relief which applies to gains made on the disposal of investments in ordinary shares may come to an end effectively cutting the Capital Gains Tax by 50 to 10.

. But because the higher tax rate as. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12. The current capital gain tax rate for wealthy investors is 20.

May 11 2021 800 AM EDT President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the. The annual limit on HSA contributions for 2021 is 3600 for self-only and 7200 for family coverage. The maximum zero percent rate.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Twenty-six states and the District of Columbia had notable tax changes take effect on January 1 2021. Because most states legislative sessions were cut short in 2020 due to.

However threshold amounts have increased. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to. If you have a small.

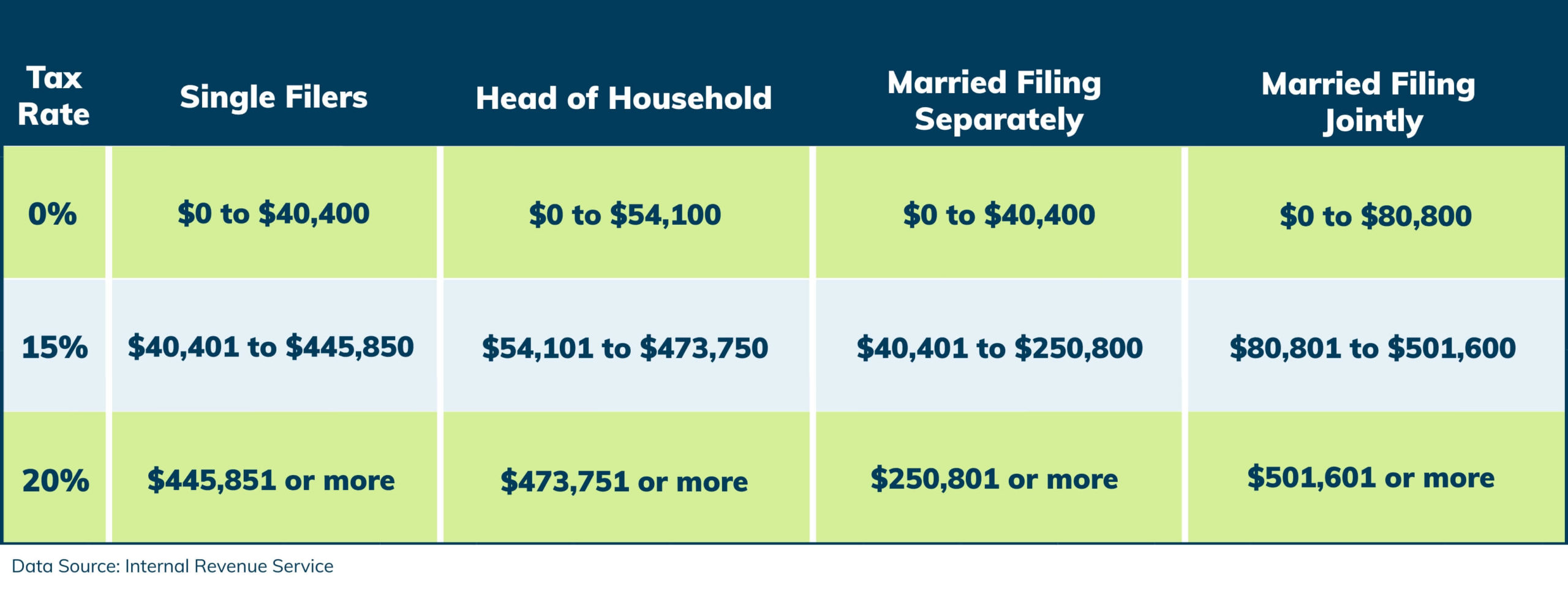

Additionally a section 1250 gain the portion of a gain. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change.

The effective date for this increase. Your 2021 Tax Bracket to See Whats Been Adjusted. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

The current long-term capital gains tax. The rates do not stop there. However theyll pay 15 percent on capital gains if their.

In 2021 tax rates on capital gains and dividends remain the same as 2020 rates 0 15 and a top rate of 20. Discover Helpful Information and Resources on Taxes From AARP. Heres an overview of capital gains tax in 2021 -- whats changed and what could change.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Ad Compare Your 2022 Tax Bracket vs.

The increase is modest keeping the. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. There are preferential tax rates for long-term capital gains taxes.

In other words for every 100 of capital. These are realized gains for assets held for at least one year. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

The proposal would increase the maximum stated capital gain rate from 20 to 25. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 Ready or not the tax return changed again during the 2020 tax season.

That is a 15 increase from 2020. You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451. A company trust or superannuation fund may be required to complete and lodge a Capital gains tax CGT schedule 2021 NAT 3423 CGT schedule as explained in part C.

Capital gains tax rates on most assets held for a year or less. The current long term capital gain tax is graduated. Because the combined amount of 20300 is less than 37700 the.

Add this to your taxable income. A summary can be found here and the full text here. 2021 Federal Income Tax Brackets.

In the US short-term capital gains are taxed as ordinary income. For example a single. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

Once again no change to CGT rates was announced which actually came as no surprise. That means you could pay up to 37 income tax depending on your federal income tax bracket.

What You Need To Know About Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Capital Gains Tax Commentary Gov Uk

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Tax Changes And Tax Brackets

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)